LINDE (LIN)·Q4 2025 Earnings Summary

Linde Beats Q4, Record EPS and Cash Flow Despite Soft Industrial Backdrop

February 5, 2026 · by Fintool AI Agent

Linde delivered Q4 2025 results that edged past consensus with adjusted EPS of $4.20 (+6% YoY) and revenue of $8.76B (+6% YoY), marking another quarter of steady execution in a challenging industrial environment . The industrial gases giant posted record full-year EPS of $16.46 and operating cash flow of $10.4B, demonstrating resilience through pricing discipline and productivity initiatives .

Did Linde Beat Earnings?

Yes — modest beats on both revenue and EPS.

*Values retrieved from S&P Global

Q4 marked Linde's sixth consecutive quarter of year-over-year adjusted EPS growth. The beat was driven by continued price attainment aligned with weighted average CPI, volume growth in the Electronics end market, and project startups .

Full-Year 2025 Highlights:

- Record Adjusted EPS: $16.46 (+6% YoY)

- Record OCF: $10.4B (+10% YoY)

- EBIT Margin: 29.8% (+30 bps YoY)

- Return on Capital: 24.2% (industry-leading)

- Shareholder Returns: $7B+ via dividends and buybacks

What Did Management Guide?

2026 guidance slightly below Street expectations, but management cites no economic improvement assumption.

*Values retrieved from S&P Global

Management emphasized that the guidance midpoint "assumes no economic improvement," suggesting upside if industrial activity recovers . Currency is expected to provide a ~1% tailwind for the full year and ~3% in Q1 .

Capital Allocation in 2025:

- Business investments: $5.7B (project capex + M&A)

- Shareholder returns: $7.4B (dividends + net buybacks)

- Bolt-on acquisitions: >$400M (20+ deals globally)

How Did the Stock React?

Stock flat to slightly lower after modest beat and conservative guidance.

The muted reaction likely reflects the narrow beats and guidance that came in slightly below Street expectations at the midpoint. Investors may have been hoping for more aggressive 2026 targets given the $10B backlog.

What Changed From Last Quarter?

Backlog flat but quality improving; regional mix shifting toward Americas.

Notable developments:

- Major win: World-scale low-carbon ammonia facility in Louisiana

- Space investments: Major infrastructure to support space sector in Florida and Texas

- M&A velocity: 20+ bolt-on acquisitions closed globally in 2025

Q&A Highlights: What Management Said

On Europe's Outlook

"Unfortunately, based on what we see at the moment, I have to say that the market continues to see broad-based weakness. That's been the theme for a number of quarters over the last couple, three years now... There are some bright spots — Europe North, with the Scandinavian countries, continues to grow even in these conditions."

On China Bottoming Out

"In my assessment, the China markets that we supply and work with closely are largely bottoming out... Our China business, our merchant business, to our end customers, grew at a rate higher than the published IP number, which was 5% for the last quarter."

On the Space Opportunity

"We only measure by the number of launches where Linde is directly involved... The number ranges between 65%-75% on average... I'm looking forward to having a billion-dollar business that I can split out in the end markets and show it to you guys separately. I expect to see that happen in the next few years."

On Margin Expansion

"On 2026, my expectation remains that we will be above the long-term margin range that we normally offer you. We always say 30-50 basis points is what you should expect. My view is in 2026, we will beat that number."

On Leading Indicators

"The U.S. hard goods automation equipment sales in the fourth quarter were up again... But on the consumables end, we do not see that optimism or that growth come through. Consumables are flat at best, maybe a little bit down. So people are preparing for what is likely to come and have some cautious optimism around growth in manufacturing."

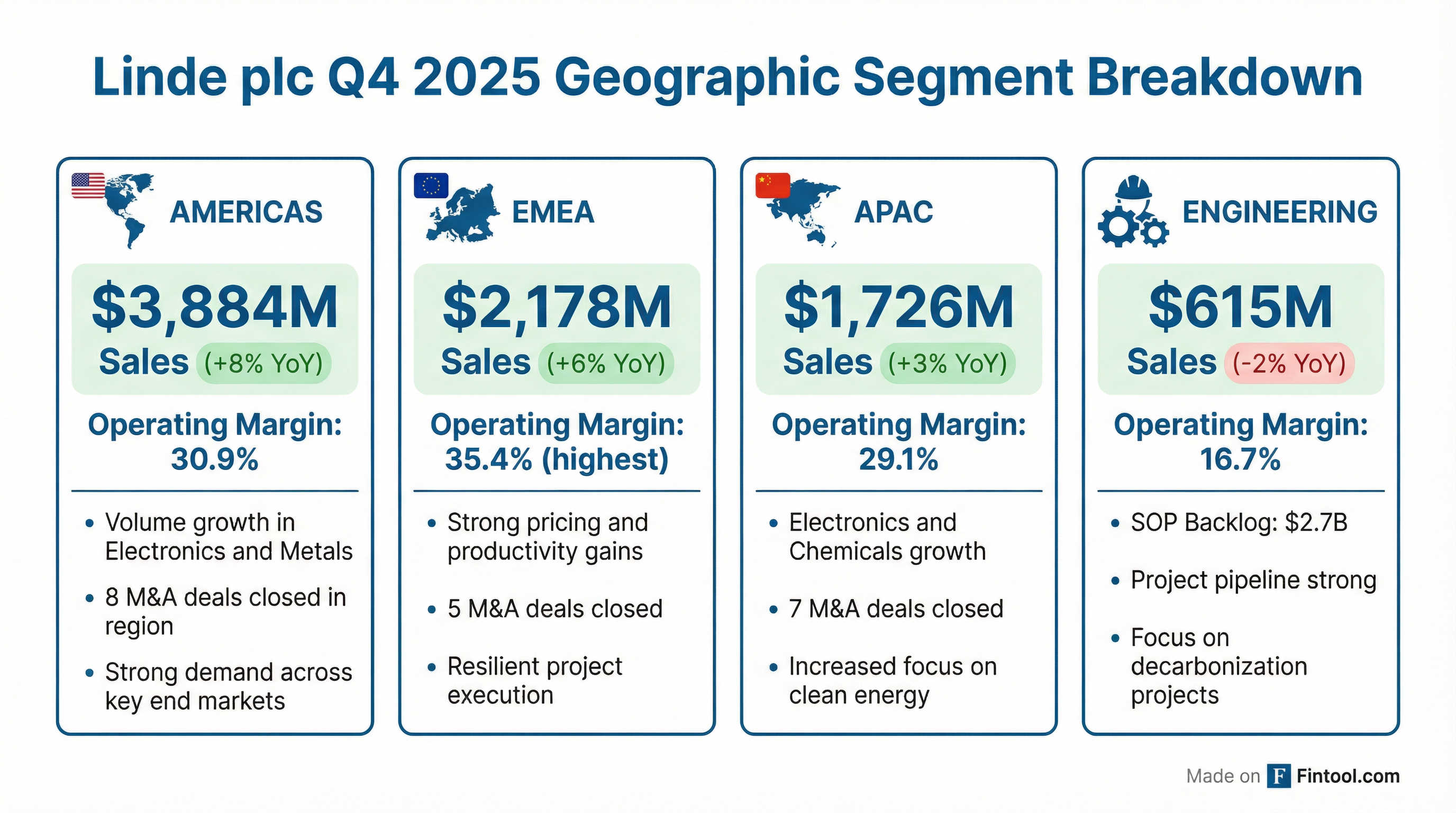

Segment Performance

Americas (+8% YoY)

The strongest growth region with sales of $3.88B . Volume growth was led by Electronics and Metals & Mining end markets. Americas closed 8 M&A deals in 2025, primarily in U.S. packaged gases . Operating margin of 30.9% was impacted by cost pass-through but remains healthy.

EMEA (+6% YoY)

Sales of $2.18B with industry-leading operating margin of 35.4% . YoY FX tailwind from EUR strength helped topline. Volume declined 3% YoY due to weakness in Manufacturing and Chemicals & Energy, but strong pricing and productivity offset the impact.

APAC (+3% YoY)

Sales of $1.73B with sequential margin improvement to 29.1% . Growth driven by Electronics and Chemicals & Energy end markets. The region closed 7 M&A deals and showed good cost management despite helium and rare gas pricing headwinds.

Regional Deep Dive from Q&A:

- China: "Largely bottoming out" — merchant sales to end customers grew faster than 5% published IP . EV sector strong (BYD growing 28%)

- India: Strong growth across all end markets and distribution modes; EU Free Trade Agreement and US-India tariff resolution provide catalysts

- Australia: Still declining in Q4 but showing signs of stabilizing; comps improve in 2026

- ASEAN: Flat at best; fortunes tied to China recovery

Engineering (-2% YoY)

Sales of $615M with operating margin of 16.7% . SOP (Sale of Plant) backlog stands at $2.7B. Order intake was $434M in Q4, lower than Q4 2024's $880M, but execution remains solid.

End Market Trends

All end markets showed YoY sales growth in Q4 :

Electronics continues to be the standout performer, benefiting from semiconductor demand and AI-related infrastructure buildouts. This aligns with the 65% clean energy exposure in the backlog, as many of these projects support sustainable manufacturing.

Capital Allocation & Shareholder Returns

Linde returned $7.4B to shareholders in 2025 :

Business reinvestment totaled $5.7B, split between base capex ($2.6B) and growth capex/acquisitions ($3.1B) .

The company maintains a strong balance sheet with net debt of ~$22B and net debt/EBITDA of approximately 1.6x.

Space Sector: A Secular Growth Story

Management provided significant color on Linde's space opportunity during the Q&A:

The company just started up a new plant in Brownsville, Texas in January 2026 to support growing launch demand . Management emphasized this is factored into guidance but "isn't big enough to move the needle for Linde as a company overall" yet .

TSMC Arizona Update

Management provided an update on the TSMC fab wins:

- Fab 1: Fully operational and utilized

- Fab 2: Commissioned, ramping up as planned

- Next Round: Under discussion with strong commitment to Phoenix

- Gas Intensity: Increasing with advanced nodes as both usage per node rises and new specialty gases are introduced

This validates Linde's position as "the anchor industrial gas supplier for some of the largest and most successful clean energy and advanced electronics fabs in the world" .

Helium & Rare Gas Headwinds

Management quantified the impact of commodity gas headwinds:

- 2025 EPS Impact: ~1-2% headwind from helium and rare gas combined, toward the upper end

- Pricing: High single-digit negative pricing on helium for several quarters

- Outlook: Helium expected to remain "long in the medium term" with no dramatic changes expected

- Russia Impact: Chinese market seeing impact of Russian helium, with some leakage to other markets

- Mitigation: Linde invested in a storage cavern to help balance supply-demand

Rare gas outlook is slightly better with electronics recovery providing some relief .

ESG & Sustainability Progress

Linde highlighted significant progress toward 2028 sustainability goals :

- GHG Intensity: Reduced ~45% from 2018 baseline, on track for 35% target by 2028

- Low-Carbon Energy: ~50% of electricity consumption from low-carbon sources

- Clean Energy Projects: 65% of SOG backlog tied to clean energy

- Customer Decarbonization: 90+ new customer wins using oxy-fuel combustion for emissions reduction — technology helps customers reduce emissions, lower natural gas consumption, and increase throughput; wins concentrated in China but also across Americas and EMEA

Restructuring & Productivity Actions

Management initiated additional restructuring in Q4 to position for 2026:

Operating Leverage Built In: Management noted that when volume recovery comes, earnings leverage quickly — pointing to 2021 when volumes up 7-8% drove EPS up 30% .

Risks & Considerations

Key risks flagged in the forward-looking statement :

- Macroeconomic uncertainty and potential trade conflicts/tariffs

- Cost and availability of electric power and natural gas

- Currency fluctuations

- Ability to achieve price increases to offset cost inflation

- Integration execution on bolt-on acquisitions

The guidance's "no economic improvement" assumption is notable — if industrial activity rebounds, there's upside to the $17.40-$17.90 EPS range.

What Should Investors Watch Next?

Near-term catalysts:

- Q1 2026 results (expected late April/early May)

- New project announcements from the $10B backlog

- M&A activity continuation in 2026

- Industrial activity data (Manufacturing PMI, etc.)

Key questions for next quarter:

- Is volume growth broadening beyond Electronics?

- Will pricing power persist as inflation moderates?

- Any update on the Louisiana ammonia project timeline?

- Is China recovery momentum continuing post-Chinese New Year?

- Progress on signing new "signature fab wins"

Key Financials (8-Quarter History)

*Values retrieved from S&P Global

Related: